Prospective buyers will take the extra expenses associated with the flood insurance policy, and the risk the property could be damaged by flooding into account. The cost of yearly flood insurance could affect what buyers can afford, and what they are willing to pay for a property. Whether you’re a seller or a buyer, keep in mind that a home’s value is likely to be affected if it is in a flood plain. Does being in a flood zone affect a home’s price? If you are in a high flood-hazard zone, flood insurance can be significantly more expensive-as high as $6,000 per year. Of course, the amount you pay is all based on your property’s flood risk and where you are in the floodplain, as specified on the flood insurance rate map. The average cost of flood insurance through the NFIP is $700 per year. The amount you pay for your policy is based on such factors as the age of your home (year of construction), building occupancy, number of floors, location of contents, flood risk, location of the lowest floor (in relation to the Base Flood Elevation on a flood map), and your deductible. The federal government offers subsidized flood insurance to property owners through the National Flood Insurance Program. If the property is found to be in a flood zone, the mortgage company will require flood insurance. If you intend to finance your home purchase, the mortgage company will investigate the most updated flood zoning as well.

Flood plain zone full#

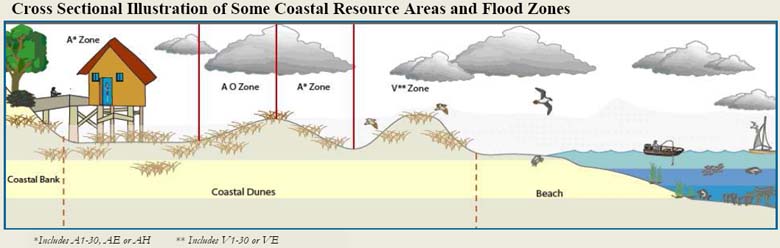

That said, full disclosure is certainly the ethical responsibility of the seller and the listing agent and home shoppers are encouraged to thoroughly review the Residential Property Disclosure.Īs a buyer, you should research the property and flood maps-or have your real estate agent check-to see if it’s in a flood hazard area. Federal laws don’t require disclosure of previous flooding. While all states have laws regarding property disclosure, the specific laws regarding FEMA flood zone status vary from state to state. Is a property’s flood zone status disclosed to home shoppers? You can also ask your insurance agent as they have access to this information and a great starting point but if they advise that the home is located in a high risk area and that a flood insurance policy is required, double check this using FEMA’s website.įlood maps are updated periodically, based on new developments and FEMA-funded flood-control projects within a given floodplain, so be sure you’re working with FEMA’s most current information. Aside from FEMA and flood maps, other resources include tax record databases and title searches both will indicate a property’s flood risk. Keep in mind when looking at the FEMA map that it’s possible that only part of your lot-and perhaps not your home itself may be in the flood zone. Zone AE, for example, has a 1% probability of flooding every year, also known as a 100-year floodplain-a low flood hazard. Zones B, X, and C are at the lowest risk, while high-risk zones start with either an A or a V (V zones are coastal areas) on the map.

Simply enter a property’s address on the FEMA Flood Map Service Center website, and a map showing its flood zone hazard will pop up. The best place to start is FEMA’s Map Service Center. Most homes in high-risk flood zones are near a body of water. But regardless of your location, there are a few ways to determine your home’s flood hazard and whether flood insurance is required.

Flood plain zone how to#

How to find out if your property is in a flood zone? So how do you find out if your home is in a flood zone, and what type of flood zone it is? The answer is on the map. regions most vulnerable to hurricanes), your property may still be located in an area that has been deemed at high risk of flooding. So while you may not live in the Gulf Coast (one of the U.S.

An areas classification is based on the estimated frequency of storms that are likely to occur which would cause flooding in an area. These rankings are determined by the Federal Emergency Management Agency and represented on special maps. In fact, there are a little over a dozen flood zone classifications. “Is my/the property in a flood zone?” That’s a question that concerns both homeowners and home shoppers-and not just those near large bodies of water.

0 kommentar(er)

0 kommentar(er)